How did textile and fabric manufacturers survive the global pandemic? How do supply chain issues and labor shortages continue to be a problem? What markets are manufacturers looking to expand into, and how do they plan to get there? Which trends will have the biggest impact on the industry in the next two years?

The 2022 State of the Industry Report by the Advanced Textiles Association (formerly IFAI) attempts to take the pulse of manufacturers and businesses in the industrial fabrics industry and answer these questions among others. ATA conducts research annually among its members and across the industrial fabrics industry. This survey recorded the views of nearly 300 industry professionals. These included end-product manufacturers and fabricators (21%), equipment manufacturers (9%), marine fabricators (6%) and distributors (8%) among others.

In some instances, percentages were rounded up to the next whole number, while scaled answers such as “important” and “extremely important” were combined for clarity.

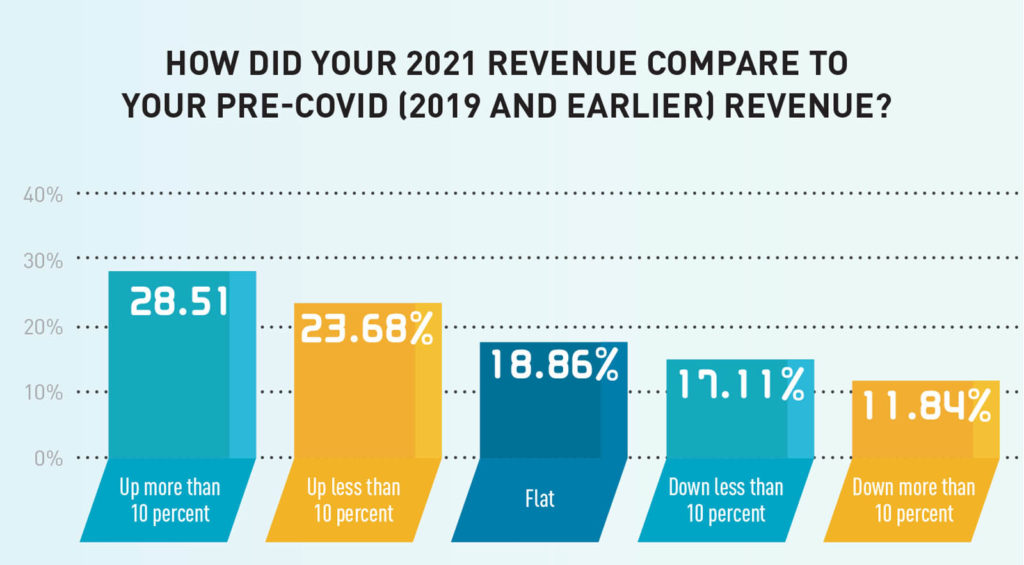

As we continue to pull out of a global pandemic, with lessons learned about how to cope with a sudden and dramatic change in how businesses operate, we see businesses for the most part returning to normal and equaling or surpassing pre-COVID conditions.

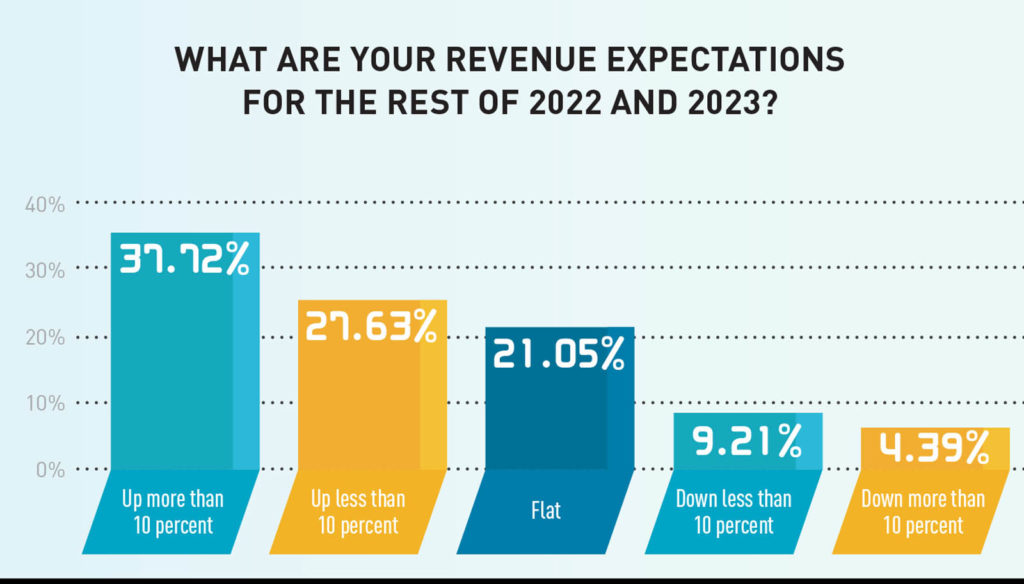

This report is the result of questionnaires sent to ATA members earlier this year. The respondents gave a snapshot of how their businesses have changed over the last two years, and what they anticipate for their futures. And, in tandem with reports on the textile industry outlook globally, despite some ongoing problems, the future looks positive.

A perfect storm

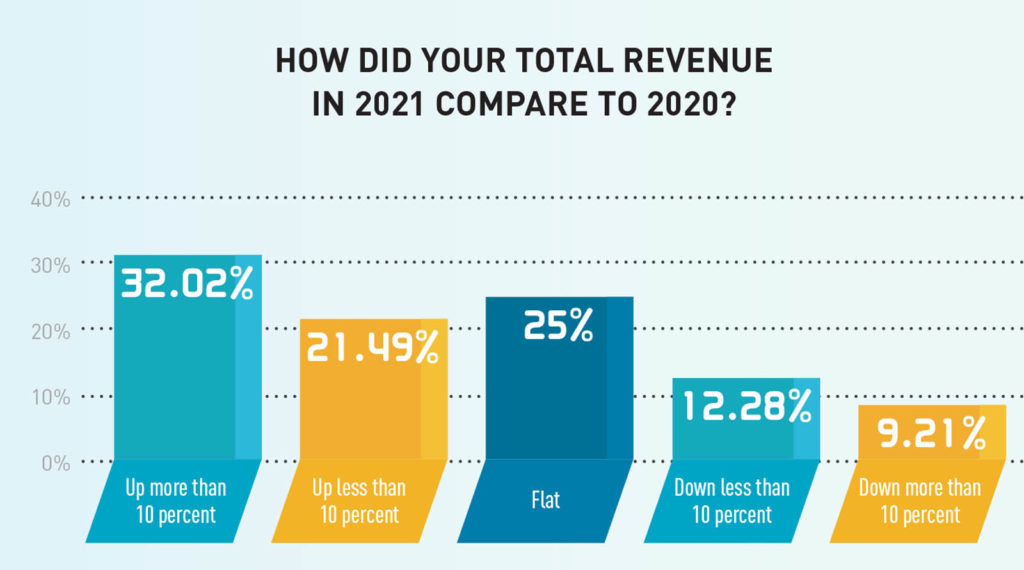

As we saw with our last State of the Industry Report (Specialty Fabrics Review, July 2021), survey respondents had predicted a positive economic outlook for the coming year despite the pandemic. A majority (53%) reported their revenue had gone up compared with 2020, with 32% of respondents seeing an increase of more than 10% from the prior year. Still, not everyone came through the last year unscathed. For some 21% of respondents, revenue had decreased, with 9% reporting their revenue declined by more than 10%.

2021 was a “perfect storm” of several negative and unpredictable factors that impacted most industries around the world. Of course, the pandemic was largely to blame for many of these problems such as inflation, supply chain delays, maintaining or increasing production capacity and increased shipping costs. In our survey, these issues impacted nearly three-quarters of respondents overall. For example:

• According to the U.S. Bureau of Labor Statistics, more than 47 million Americans voluntarily quit their jobs last year—an unprecedented mass exit from the workforce that economists are calling the Great Resignation. Possible causes include wage stagnation amid the rising cost of living, long-lasting job dissatisfaction, safety concerns of the COVID-19 pandemic, and the desire to work for companies with better remote-working policies. As a result, many businesses struggled to find skilled workers, and the textile industry is no different. Among our survey respondents, more than half continued to have trouble filling both full- and part-time positions.

• Concern for worker safety during the pandemic meant that many industries nationwide introduced remote work options. Among our respondents, 31% said that between 50 and 74% of their employees were now working remotely. More than 62% of respondents expected COVID-related concerns to continue throughout the year.

• Getting the raw materials to manufacture products continues to be a problem for many industries, resulting in price increases for their customers. When asked whether they had to increase the prices they charge to customers over the last year, survey respondents overwhelmingly reported they had.

• At the time of this survey, the impact of the war between Russia and Ukraine which began in February was largely unknown, and as this issue goes to press, it continues with no end in sight. More than 53% of respondents said their businesses were affected to some degree by the war. However, the continuing conflict is impacting fuel costs globally as many European countries have decreased or banned Russian oil exports, sending the price of a barrel of oil skyrocketing. Now we know that this has had a tremendous ongoing effect on the prices at the gas pump.

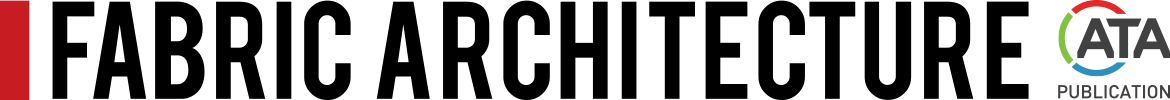

How did these events impact our survey respondents? A majority have had to raise the prices they charge to customers. Nearly half (49%) have had to raise prices by 10 to 20 percent, while 13% of respondents raised prices by more than 25%. Less than 8% have seen no price increases.

When asked what drove these price increases, nearly 63% said they were passing on costs from suppliers. Other reasons included higher taxes or other government fees (31%), increased wages for employees (58%), higher rent or facility costs (29%) and investing in new equipment (24%). Several respondents noted that significant increases in gas and oil prices and transportation/shipping costs had forced them to increase prices to customers. One respondent cited slower production rates from new employees still in the ramp-up period.

Planning for the future

We asked respondents what areas of strategic development were among the most important to their business growth in the next two years. As we’ve seen, pandemic factors have stalled many businesses, so improvements to the supply chain and logistics topped the list for 60% of respondents.

Implementing automation was also seen as extremely or somewhat important by 49% of respondents, as they confront labor shortages in the face of increased production demands. Along the same lines, employee development programs were vital to half of the respondents (50%).

Product diversification (45%) and research and development of new products (53%) were key to strategic plans for many. Developing public and private partnerships with government and higher education (where much of textile development takes place) was noted as extremely or somewhat important for 37% of respondents.

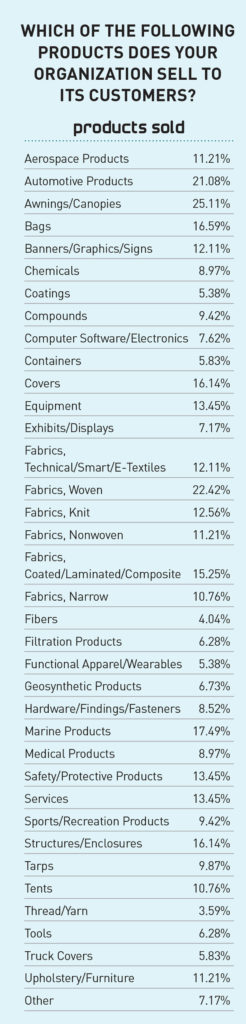

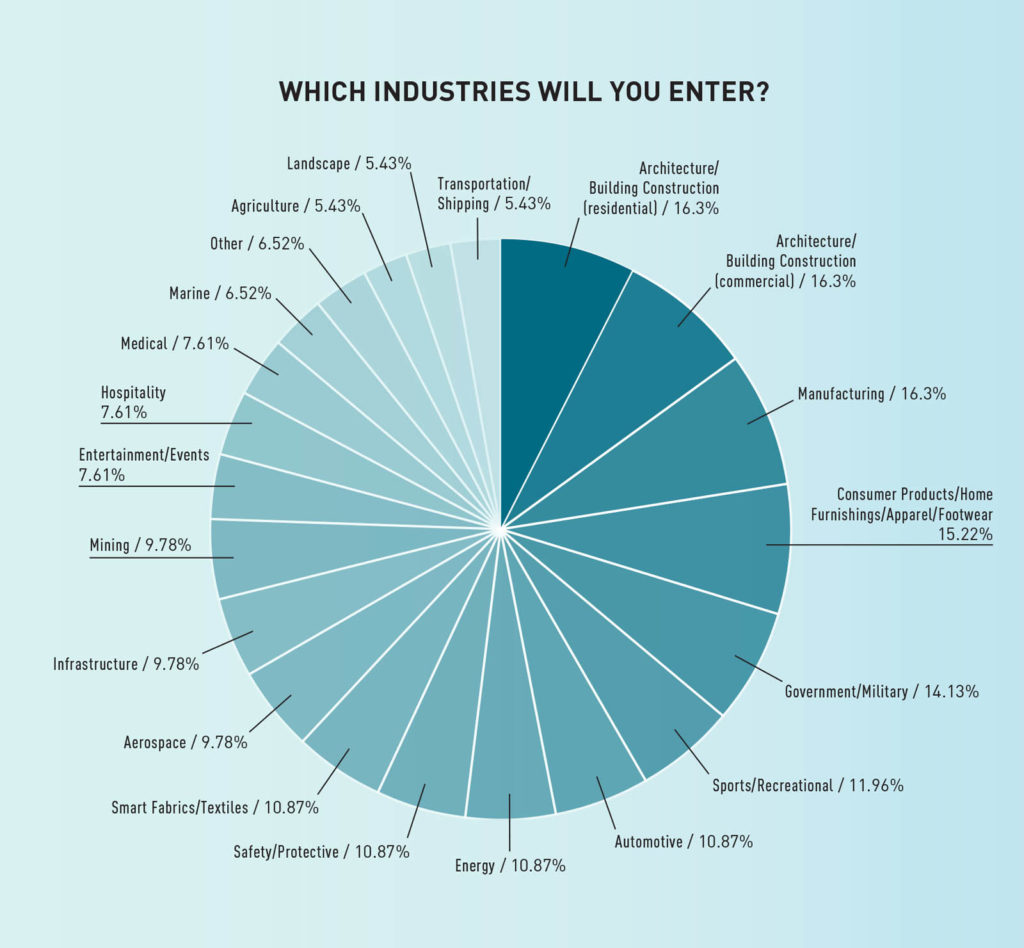

Every business must continually look for new segments in which to expand and help their businesses grow. Nearly 48% of survey respondents expected to enter a wide variety of new markets in the next few years.

Among those noted by respondents, 33% planned to expand in architecture/building construction for residential and commercial customers in the coming years.

Slightly more than 15% expected to pursue consumer products, home furnishings, and apparel (including footwear), while 14% were looking to expand into government and military markets. Other market segments included aerospace, automotive, entertainment and events, medical, “smart” fabrics and textiles, sports and recreational. And as one respondent noted, “Any market we can find business in, we will explore.”

Tim Goral is the senior editor of Specialty Fabrics Review.

TEXTILES.ORG

TEXTILES.ORG